In the fast-paced world of cryptocurrency options trading, timing and execution are everything. Today, I'm excited to share a powerful trading automation tool I've developed: a Telegram bot that executes a short strangle strategy on Bitcoin options with just a few clicks. This article will walk you through the strategy, its risk-reward profile, and how the bot makes professional options trading accessible to everyone.

The 1% Short Strangle Strategy: A Statistical Edge

What is a Short Strangle?

A short strangle is an options strategy where you simultaneously sell an out-of-the-money (OTM) call option and an OTM put option with the same expiration date. It's a market-neutral strategy that profits from time decay and low volatility.

Why 1% Strikes?

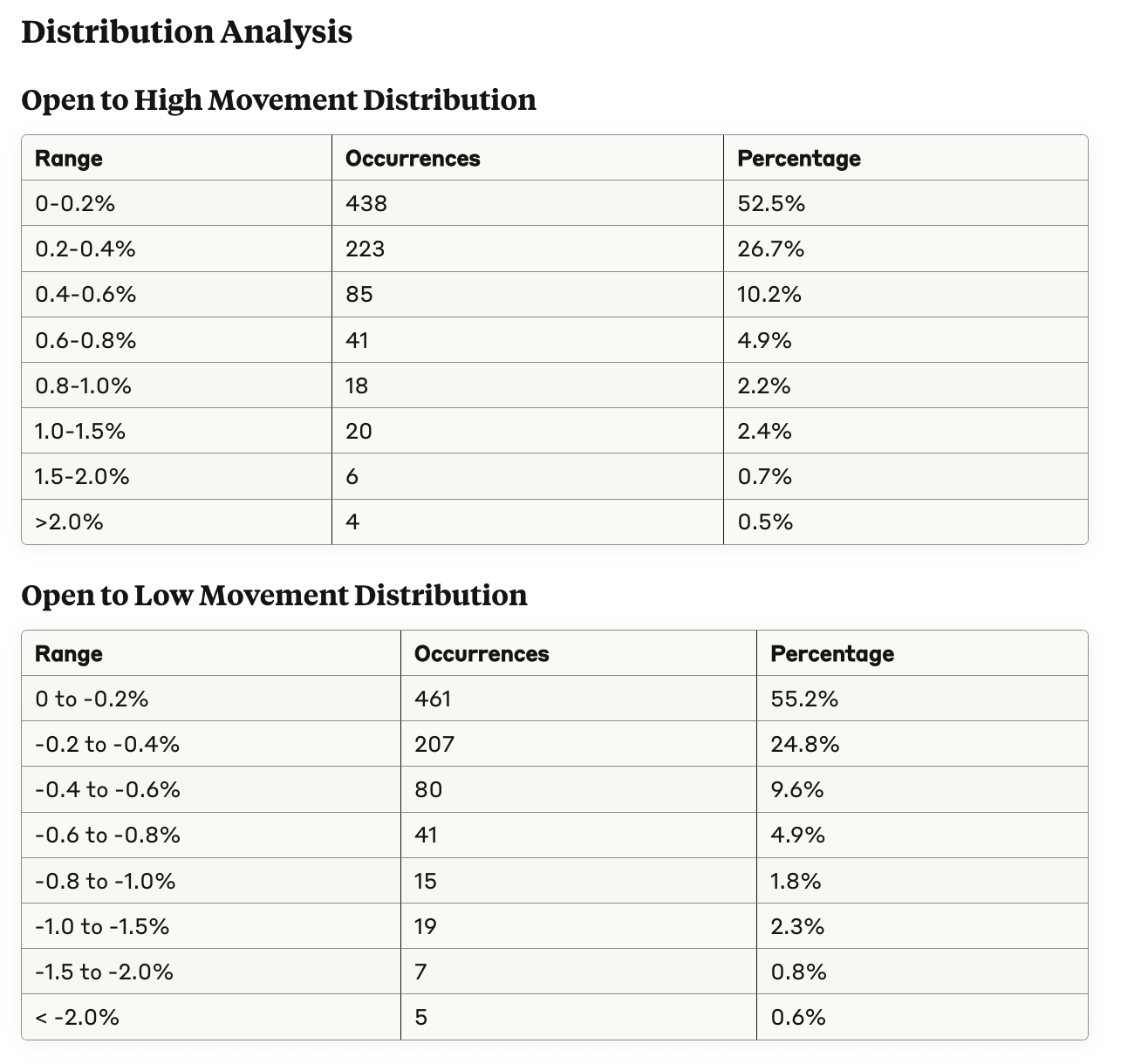

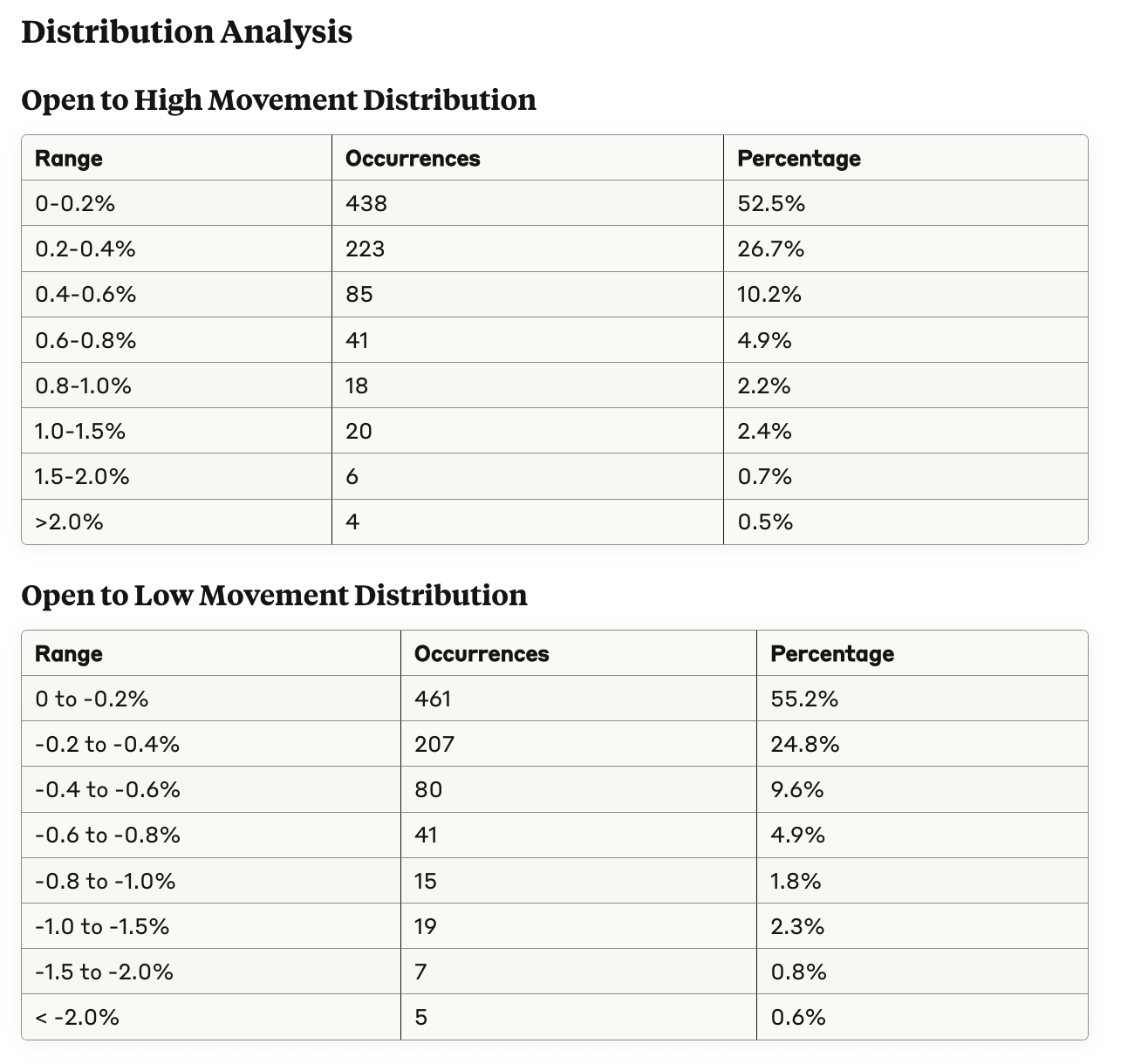

Analysis of BTCUSD price movements during the 7AM-12PM timeframe reveals consistent patterns with moderate volatility. The data shows that Bitcoin typically moves up 0.283% from open to high and down -0.265% from open to low during these morning hours.

Key Insights

- Low Volatility Dominance: Over 79% of the time, the high is within 0.4% of the open, and the low is within -0.4% of the open.

- Symmetric Movement: The average upward and downward movements are nearly identical in magnitude (~0.28% up vs -0.27% down), suggesting balanced buying and selling pressure.

- Extreme Movements are Rare:

- Only 0.5% of sessions see gains >2%

- Only 0.6% of sessions see losses >2%

- Typical Trading Range: The average range (high-low) during these hours is approximately 0.55% of the opening price.

- Risk/Reward Profile:

- 95% of upward moves are under 0.8%

- 95% of downward moves are within -0.8%

- This suggests tight stop-losses could be effective during these hours

This data suggests that selling options 1% away from the current price captures premium while maintaining a favorable probability of success.

Executing this strategy manually requires:

- Checking for today's expiry options at 7AM

- Calculating 1% offset strikes

- Finding the closest available strikes

- Placing two market orders

- Setting stop losses for risk management

- Monitoring positions throughout the day

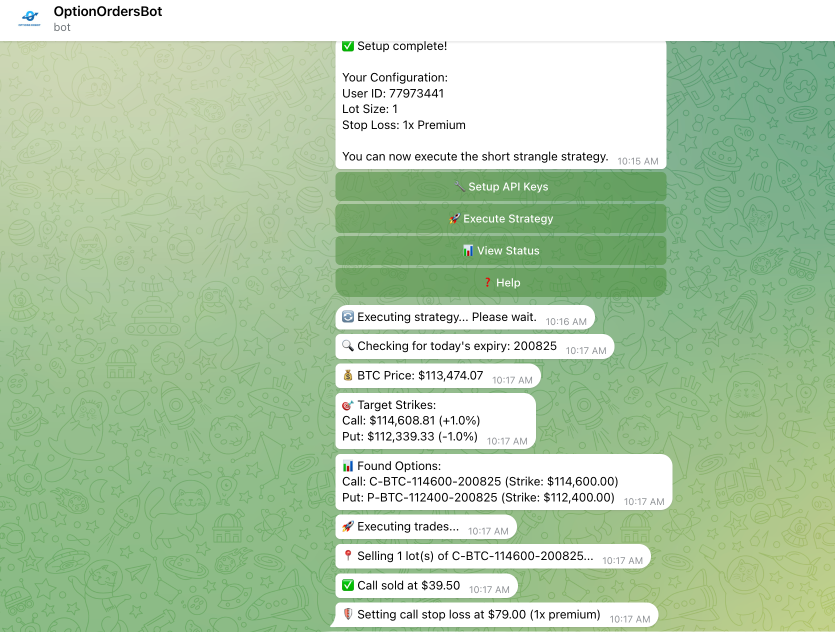

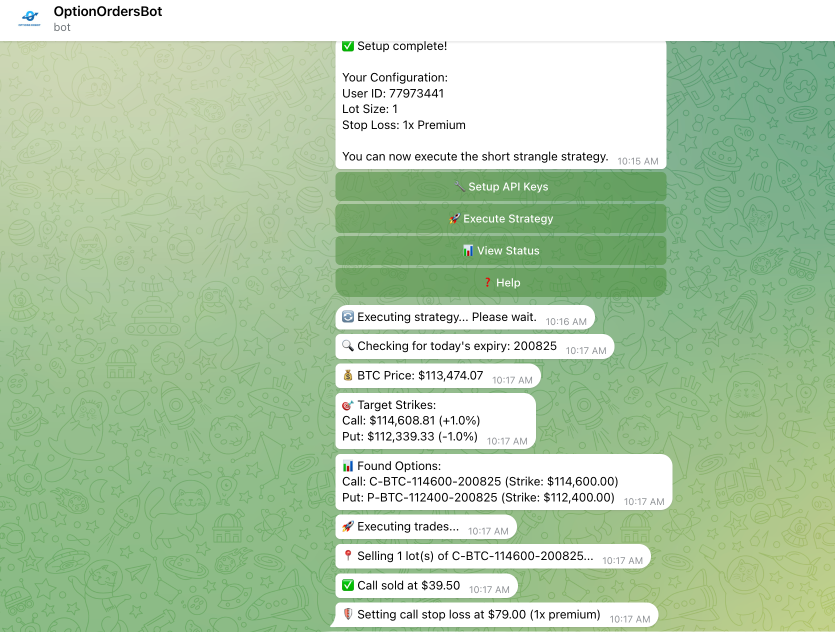

This process is time-consuming and prone to emotional decision-making or execution errors. The Solution: A Telegram Trading Bot I developed a Telegram bot that automates the entire process while giving traders full control over their risk parameters. Here's what makes it special:

Key Features of the Bot : https://t.me/OptionOrdersBot

1. User-Friendly Setup

- Simple API credential configuration

- Secure storage of user preferences

- One-time setup process

2.

Customizable Risk Management Users can choose their stop loss preference:

- 1x Premium: Tight stop loss (conservative)

- 2x Premium: Balanced approach

- 3x Premium: Higher risk tolerance

3.

Real-Time Execution Feedback The bot provides step-by-step updates:

🔍 Checking for today's expiry: 201124

💰 BTC Price: $95,234.50

🎯 Target Strikes:

Call: $96,186.85 (+1%)

Put: $94,282.16 (-1%)

📊 Found Options:

Call: C-BTC-96000-201124

Put: P-BTC-94000-201124

🚀 Executing trades...

4. Safety Features

- Confirmation required before execution

- Automatic stop loss placement

- Detailed execution logs

- Position tracking

Technical Architecture Core Components

- Delta Exchange API Integration

- Authenticated requests for trading

- Real-time price feeds

- Order management

- Telegram Bot Framework

- Interactive keyboard navigation

- Conversation state management

- Error handling

- Data Persistence

- User credentials (encrypted recommended)

- Trade history

- Execution logs

Security Considerations

- API credentials never leave the server

- IP whitelisting on exchange

- User-specific isolation

- Audit trail for all actions

Conclusion :This Telegram bot transforms a sophisticated options strategy into a simple, executable system that anyone can use. By combining statistical edge with automation, it removes emotional decision-making and execution errors from the equation. The beauty of this approach lies in its accessibility – professional-grade options trading is now just a few taps away on your phone. Whether you're a seasoned trader looking to automate your strategy or someone new to options wanting a systematic approach, this bot provides a robust framework for consistent execution.