There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

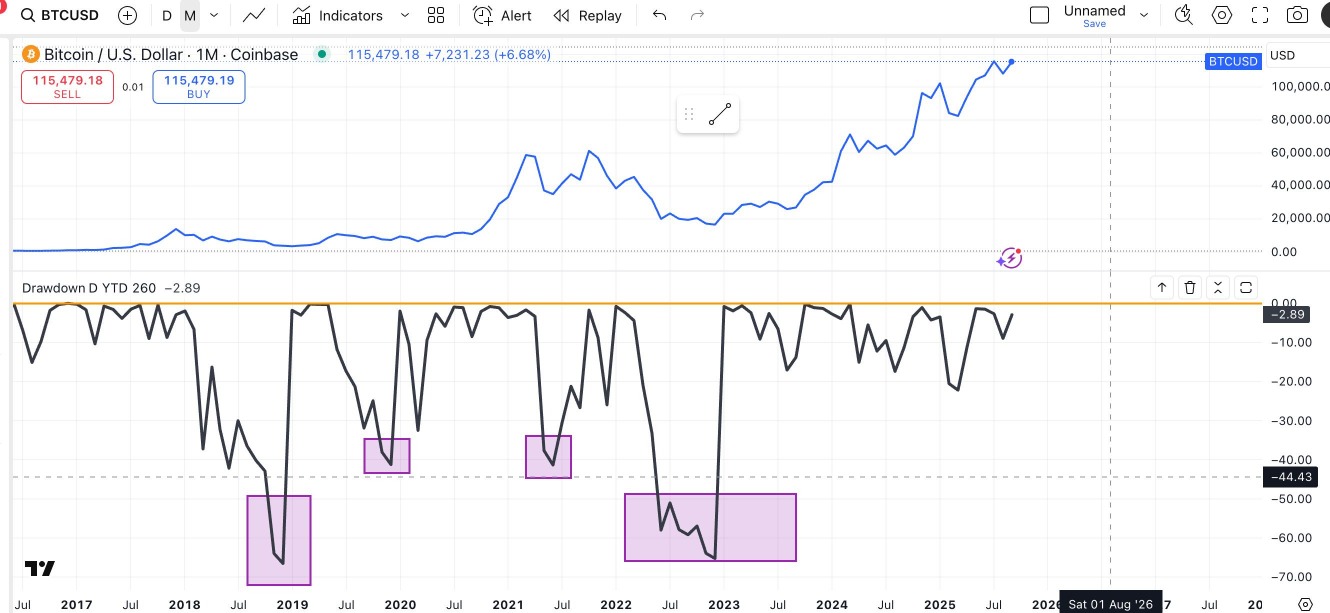

Every time Bitcoin went into correction, I claimed the bubble had burst. Every single time, it proved me wrong.

Mon Sep 15, 2025

One day I stepped back from price charts and decided to actually learn everything about crypto trading. This comprehensive guide explains what I learned - and will help you take your first trade in the crypto markets.

The Initial Doubts We All Share

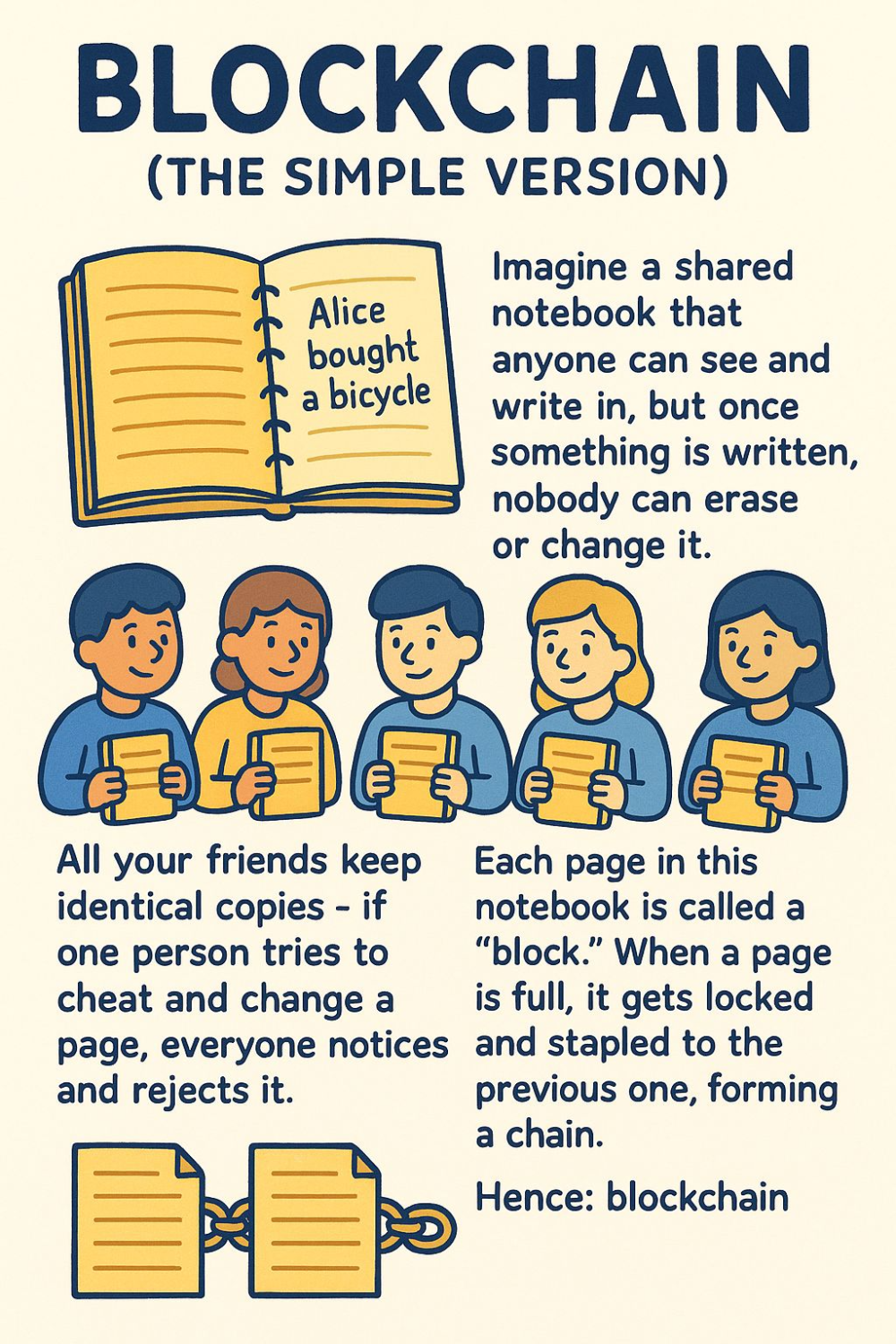

Just like everyone entering this space, I had my doubts. "At least stocks have underlying businesses," I thought. "What does crypto have? Blockchain?" I was too naive to understand blockchain, yet the entire crypto ecosystem relies on it. Let me explain it in simple terms that finally made sense to me.

Understanding Blockchain: The Foundation of Everything

Imagine a shared notebook that anyone can see and write in, but once something is written, nobody can erase or change it. All your friends keep identical copies of this notebook - if one person tries to cheat and change a page, everyone notices and rejects it.

Each page in this notebook is called a "block." When a page is full, it gets locked and stapled to the previous one, forming a chain - hence the name "blockchain."Instead of one bank keeping records, thousands of computers worldwide keep the same record book. Every time you buy or sell, it gets recorded in ALL these books at once. No single person or company controls it - the crowd verifies everything.

This revolutionary system means:

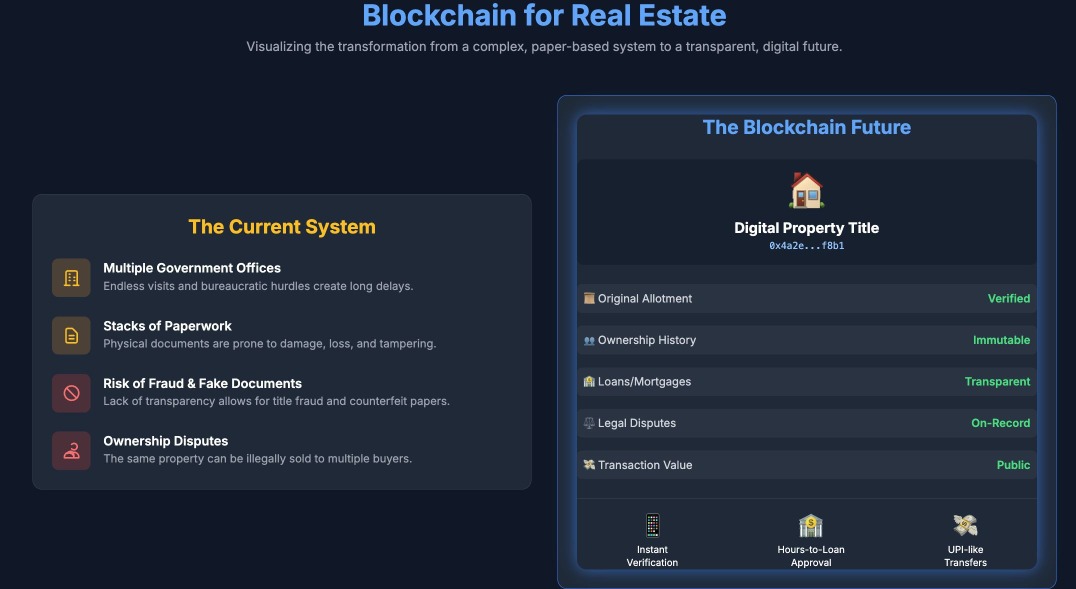

This is phenomenal tech innovation. To understand its potential, imagine if the Indian Government implemented this for Real Estate.Right now, buying property in India means visiting multiple government offices, dealing with stacks of papers, worrying about fake documents, and sometimes discovering that the same plot was sold to three different people!

The Blockchain Real Estate Revolution

With blockchain, every property would have a digital history showing:

Beyond Bitcoin: Understanding Different Cryptocurrencies

Platform Coins

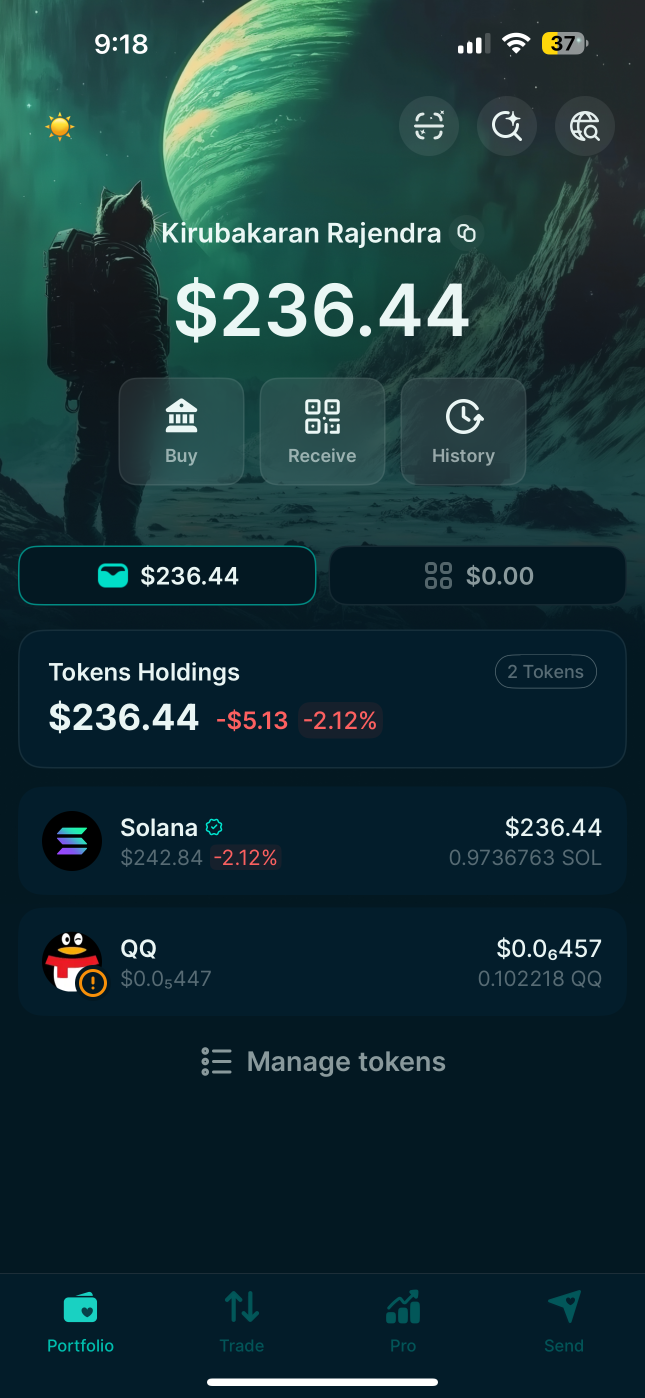

Other coins like ETH (Ethereum) and SOL (Solana) aren't companies - they're platforms where developers build apps (dApps). Think of them like Android or iOS for decentralized applications.These platforms generate value through:

Meme Coins

Then there are meme coins, where prices skyrocket purely on community-driven craze. Remember GameStop? Though the business wasn't making money, the price skyrocketed, making hedge funds lose billions. It was FOMO, greed, and fear - all kinds of emotions among retailers that pushed the price to the moon. The same phenomenon happens with certain crypto coins.

Trading in Crypto: CEX vs DEX

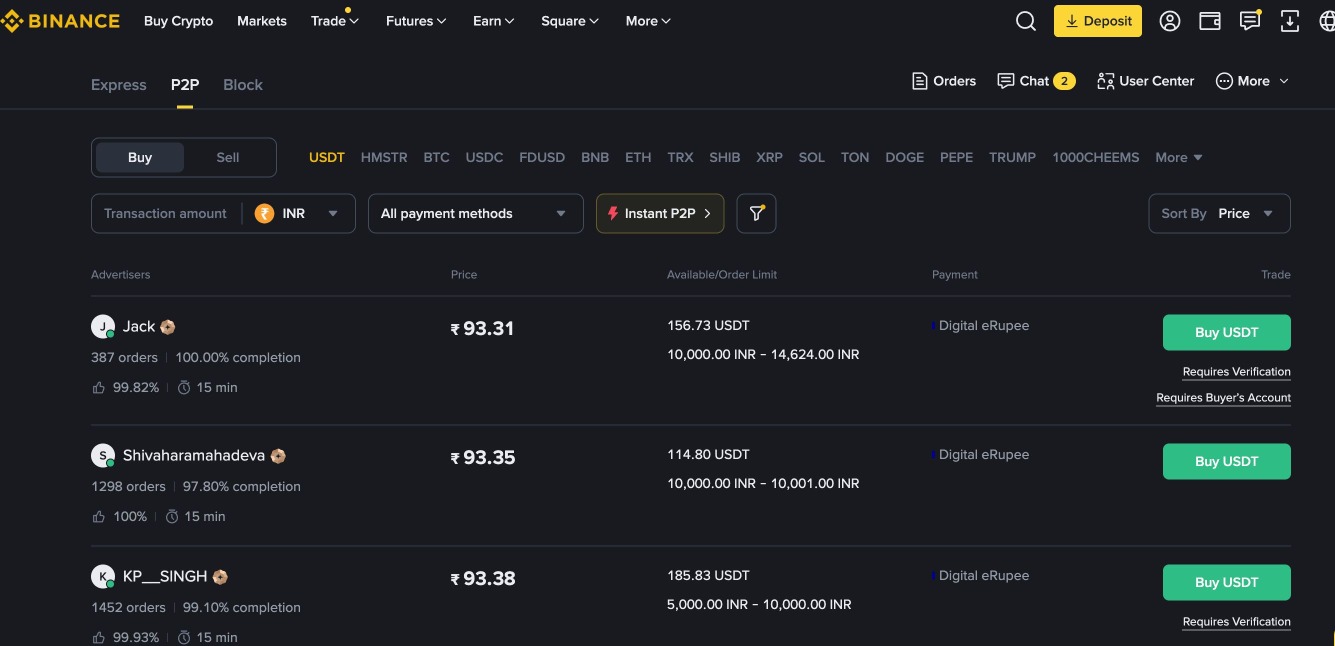

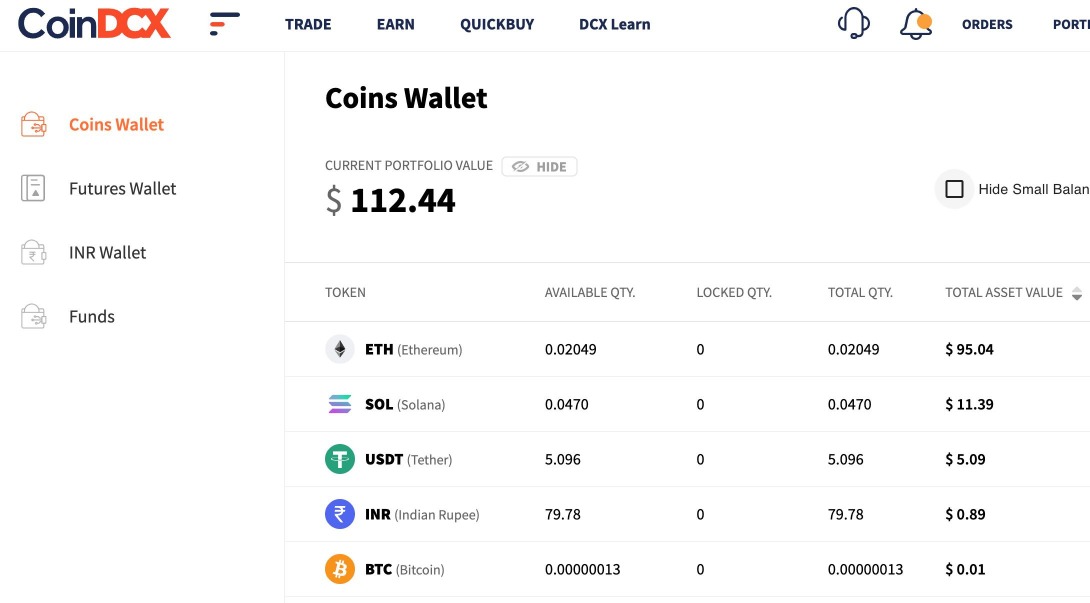

Understanding the two types of exchanges is crucial for your safety and success in crypto trading.CEX (Centralized Exchange) - Like Your Regular Stock BrokerThink of it like Zerodha or Groww. You do your KYC, link your bank account, transfer funds to the platform, then buy and sell stocks. Your holdings show in your account, but they're actually stored in depositories like CDSL or NSDL. Even if your broker goes bust, your stocks are safe - only cash balance left with the broker is at risk.With crypto CEX platforms like Delta Exchange and CoinDCX:

DEX (Decentralized Exchange) - Trading Directly with Other TradersImagine meeting other traders in a digital marketplace instead of using a broker. No KYC, no account needed. You show up with your own wallet (like bringing your own demat account that YOU control). It's like keeping share certificates in your home locker and only handing them over when you find a buyer - no broker ever holds them.

How DEX Actually Works:

To withdraw funds:

The CEX Solution for Indians

To solve these hassles, platforms like CoinDCX and Delta Exchange facilitate entire transactions through CEX. Want to buy ₹10,000 worth of Bitcoin? Simply:

Trading Costs and Opportunities Fee Structure

Crypto platforms worldwide charge fees on turnover - typically 0.05%. If you're moving from equity to crypto, forget about ₹20 per order - it doesn't exist here. For a ₹100,000 Bitcoin transaction, you'd pay just ₹100 as brokerage.

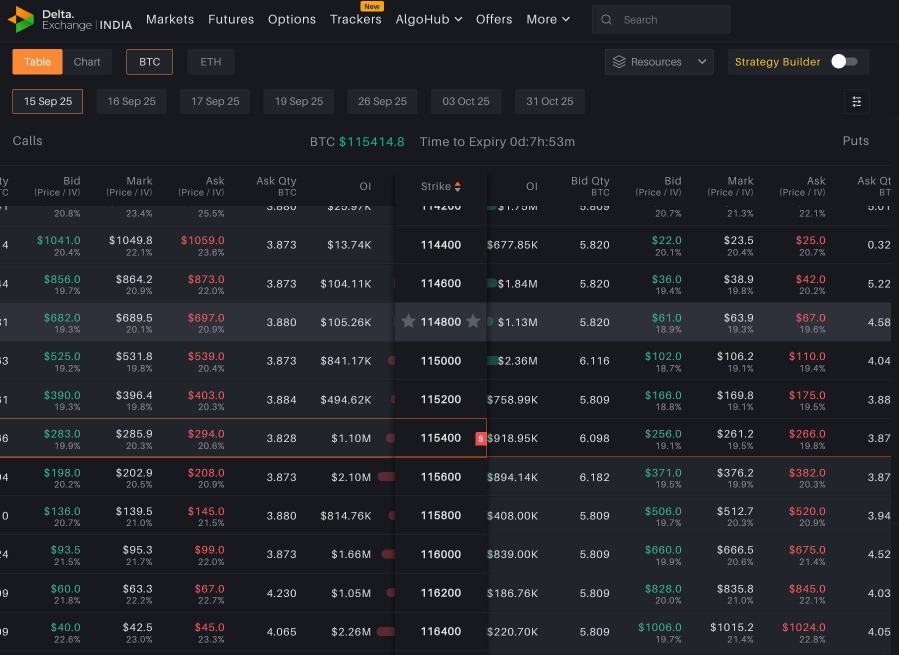

Options Trading in Crypto

In India, currently only Delta Exchange offers option trading with daily expiry on BTC and ETH. Warning: By default, spreads are more than 10%. None of the strategies you trade in Indian markets will work here. The higher the number of trades, the higher the transaction cost. You need to make more than 25% just to breakeven. If trading crypto options, ensure your trades are very limited.

Futures Trading - Where the Action Is

Crypto futures have no spread worries. Liquidity is extremely high - much higher than Nifty/BankNifty. You hardly see any slippages. Leverage can go up to 100-200x.

Critical Warning: When an asset class has volatility of more than 80%, trading with 100x leverage is a recipe for disaster. Risk management is extremely crucial here.Tax ImplicationsUnderstanding tax treatment is crucial for profitability:

The Automation Advantage

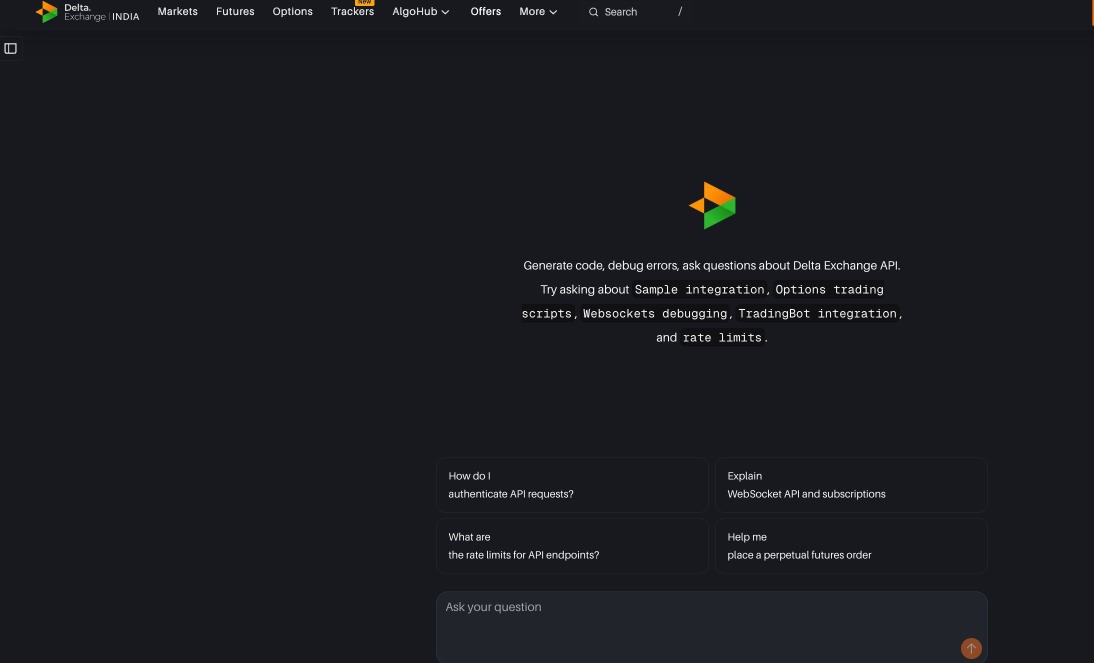

The best part of crypto trading is the ease of automation. All you need is API documentation and an AI subscription. AI will automatically write the code for you instantly. Platforms like Delta Exchange have created copilot APIs, making it even easier to automate analysis and execution without knowing coding. You can literally build a bot that trades while you sleep.

The Influencer Game - Truth Revealed

Yes, influencers get paid to promote exchanges, just like Zerodha's partner program or Upstox referral system. Crypto exchanges have referral programs too, but they typically pay 25-35% of trade commissions (vs 50% for Indian brokers).The difference lies in transparency. Good influencers educate first. However, for the sake of higher commissions, certain influencers present crypto trading as get-rich-quick schemes.

Let me be clear: Making money trading crypto is extremely hard - much harder than Nifty/BankNifty trading. Never fall for promises of quick money in crypto. It doesn't exist. Put in effort to learn about it first. Treat it as just another asset class. It will definitely reward you if you manage risk well.

The Ugly Truth - Risks You MUST KnowCrypto trading involves both volatility risk and exchange hack risks:

Essential Safety Rules:

Ten years ago, the crypto market cap was less than $5 billion. Today, Bitcoin alone has a market cap of more than $2 trillion. The total value of the top 5 cryptocurrencies exceeds all of India's top companies combined, showing the massive global impact of cryptocurrencies.

Crypto trading is just starting to gain traction in India. With so much uncertainty in the Indian regulatory space, I can see a shift happening with crypto. I seriously hope people understand the risks involved and educate themselves before jumping in to make quick money.

The Final Truth: Two Types of People

The crypto market will create two types of people:Those who understand it will see the opportunity of a lifetime - they'll learn, adapt, and position themselves for the future of finance.

Those who don't will either dismiss it as a scam and miss out entirely, or burn their hands trying to make quick money without understanding the game.

The difference isn't luck. It's education.The same technology that seems complex today will be as normal as UPI in 5 years. The question isn't whether crypto will succeed - it already has with a $2 trillion+ market cap.

The question is: Will you be ready when mass adoption comes?India is at a crossroads. While we debate regulations, the world is building the future of money. Smart money isn't asking "Is crypto real?" They're asking "How do I position myself?"Remember:

Kirubakaran Rajendran

A California-based travel writer, lover of food, oceans, and nature.