There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

How Trump's $100,000 visa bombshell sent WhatsApp groups into overdrive.

Sun Sep 21, 2025

All my School/College WhatsApp groups which weren't active for years suddenly turned crazy over this weekend because of Trump's new H1-B Visa rule. If Trump is really good at one thing, it's giving sleepless nights to traders. This weekend, he did that to Indian IT employees as well. Let me explain everything - the rules, who's affected, and what investors should do right now.

First, let's understand why Trump made this move. His administration claims massive abuse of the H1-B program. They cite shocking examples like one software company that got approved for 5,000+ H1-B workers while simultaneously laying off 15,000 Americans. The narrative is clear: American workers are being replaced by cheaper foreign labor.

H1-B visa fee increased from $1,500 to $100,000. That's a mind-blowing 66X increase! When this news broke, everyone assumed Indian IT firms would now have to spend 66x more to run their US operations through their Indian workforce. The panic was instant and brutal. Media channels went crazy. Here's why:

Indian IT companies account for 20% of ALL H1-B visas issued by the US. That's 24,766 visas out of 130,000 total. With the new $100,000 fee, quick math suggested a potential $2.5 bn annual cost! No wonder media channels went crazy over the weekend. The headlines wrote themselves: "Indian IT Sector Destroyed," "Massive Crisis for TCS, Infosys, Wipro." But here's where it gets interesting,

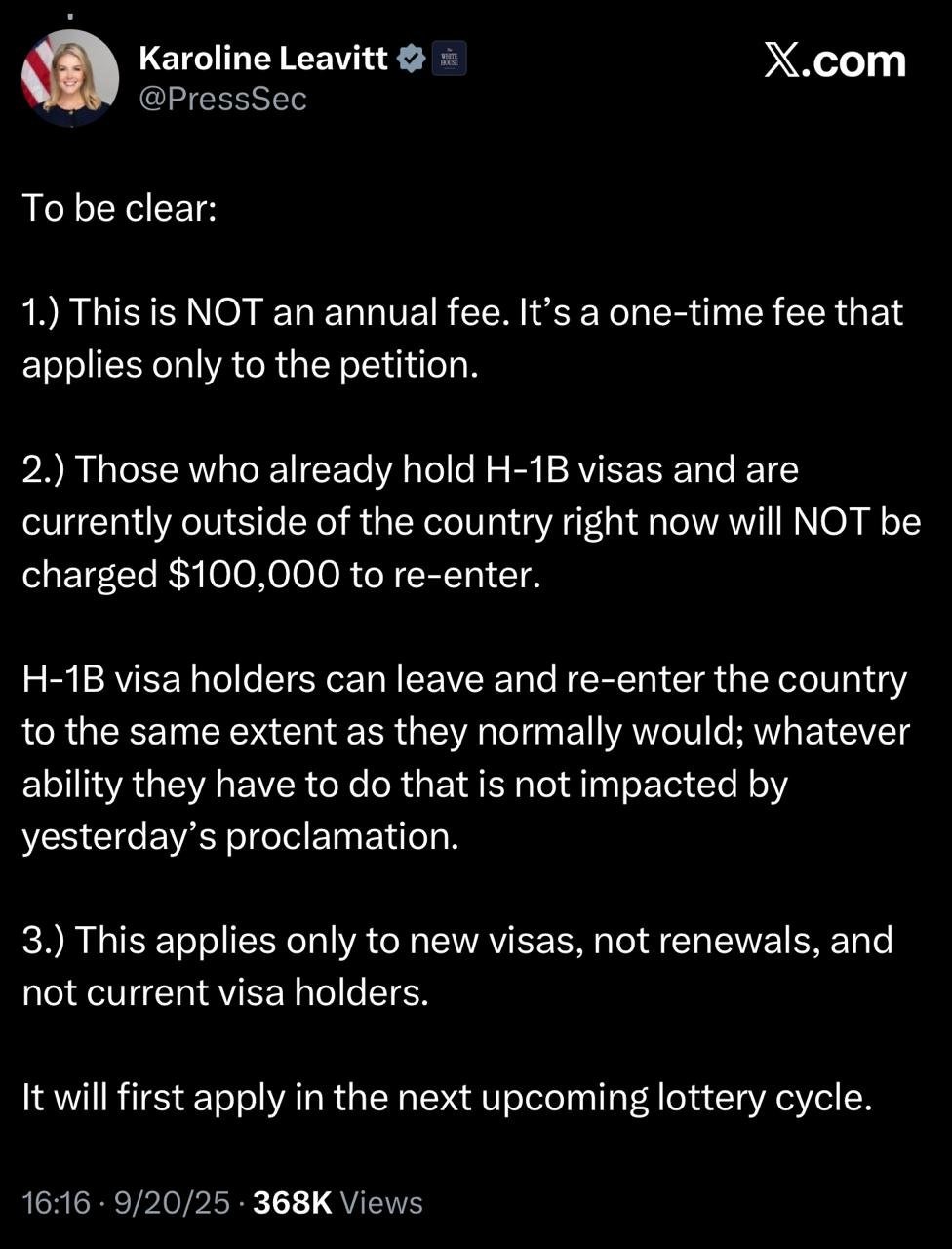

Let's look at the actual facts and ignore media narratives. After the initial panic, US Spokesperson clarified the critical details that changed everything:

Here's what most people don't know - Indian IT firms have already been reducing H1-B dependence for years:

During Y2K, dot com bubble burst, IT Index crashed more than 88% during year 2000 - 2002, but eventually increased more than 460% in next three years.

During 2008 global financial crisis, when 100 years old companies like Lehman collapsed, IT Index crashed more than 65% but in next 6 years it gained 600%

During covid crash, again IT index corrected more than 33% then in next one year it gained more than 230% and this year IT Index has seen around 30% correction, guess where it can move now?

Indian IT companies have been preparing for THIS EXACT SCENARIO for almost a decade! They didn't just wake up to this risk yesterday. If you study their annual reports, you will know that

The Indian IT is often underestimated. These companies have survived:

Each crisis made them stronger, more diversified, and less dependent on any single factor. They've shown remarkable adaptability every single time. If Trump wanted to create panic, he succeeded brilliantly. But if you look beyond the headlines, beyond the WhatsApp forwards, beyond the media hysteria - you might see a different story.

Companies like TCS and Infosys didn't become $100+ billion giants by being fragile. They became giants by adapting to every challenge thrown at them. When everyone is fearful, that's often when opportunities emerge.

Kirubakaran Rajendran

Full Time Algo Trader